Selling England (and Wales) by the pound

IN September 2015 Private Eye created an easily searchable online map (see below) of properties in England and Wales owned by offshore companies. It reveals for the first time the extent of the British property interests of companies based in tax havens from Panama to Luxembourg, and from Liechtenstein to the South Pacific island of Niue. Most are held in this way for tax avoidance and often to conceal dubious wealth.

Using Land Registry data released under Freedom of Information laws, and then linking around 100,000 land title register entries to specific addresses, the Eye has mapped all leasehold and freehold interests acquired by offshore companies between 2005 and 2014.

Using this data the Eye published a series of exposes of the companies, arms dealers, oligarchs, money launderers and others who use offshore companies. Now Private Eye, using the same data, is also publishing a database of all properties acquired by offshore companies from 1999 to 2014, showing the address, the offshore corporate owners (some have more than one) and, where available, the price paid.

- To download the 1999-2014 database, click here » (Excel file, 8.2MB)

- Download the FREE Tax Haven Special Report here » (PDF)

Freehold properties are indicated by orange shapes covering the exact area of the property. Leasehold properties are shown by purple pin points. The map includes properties owned by any overseas company, not just those based in tax havens, sometimes for legitimate reasons. Even the freehold on the saintly Eye's premises, owned by an Australian company, appears. Highlighting an individual property's details also provides a link to email the Eye with any further information readers may have about the property. In the database, where a property interest has more than one owner or "proprietor", each is listed separately, so the same property may appear more than once.

All data is from Land Registry records, which occasionally contain errors. "Price paid" figures may be totals for sales including other properties. When a property title has been identified, the underlying Land Registry record can be obtained for a £3 fee from www.gov.uk/search-property-information-land-registry.

© Crown copyright Ordnance Survey

D-Day for data

SIX months after the Eye launched its interactive online map and just as it makes its full database available the government has finally ambled slowly into action. In a consultation document published last week, business minister Baroness (Lucy) Neville-Rolfe belatedly promised to publish a list of properties owned by offshore companies.

The government acknowledges that "property can provide a convenient vehicle for hiding the proceeds of crime" and that "high values of property in London in particular, presents [sic] an opportunity for criminals to launder considerable sums of money in one transaction". So it also proposes to make transparency a condition of property ownership in the UK, as suggested by the Eye and others, "requiring foreign companies to provide information on their beneficial ownership before they are able to buy land/property in England or Wales".

Arms dealers and oligarchs

The Eye identified £170bn worth of properties acquired by offshore companies in just ten years. As most transactions did not give values, however, the total is likely to be well over £200bn. It highlighted their use by property developers such as the Candy brothers to avoid tax, the landed gentry like Lord Rothermere to escape inheritance tax and any number of arms dealers and oligarchs covering up properties they'd rather nobody knew too much about.

Among the properties were 20,590 acquired by companies registered in Jersey, 12,061 in the Isle of Man, 11,536 in Guernsey, 2,782 in Mauritius, 2,657 in Gibraltar, 1,963 in Panama and 1,245 in the Cayman Islands. But the most popular location for registering a property company offshore, with 22,155 in the period, was that convenient financial centre of... the British Virgin Islands.

While Jersey has been most commonly linked by criminal investigators to money-laundering cases, this is only because of the closer links with the authorities there. The BVI, where the identities of companies' owners are not filed with the authorities, is a tougher nut to crack. (A recent Freedom of Information request by Christian Aid for the Serious Fraud Office's risk assessment for the BVI was refused on the less than reassuring grounds that releasing it would harm relations with the territory).

A price worth paying for secrecy

Even if the government does push ahead with its new proposals, they are unlikely to solve the problem entirely. Given the UK's near total absence of enforcement against corporate law-breaking, proposed criminal sanctions for false information will probably not trouble the world's major money launderers unduly; hidden behind further offshore layers, proving falsity is hard to do without extensive investigation and international cooperation.

What action there has been against offshore corporate ownership to date has achieved little if anything.

An "annual tax on enveloped dwellings" introduced from 2013/14 was supposed to encourage property owners to drop the corporate shells. HM Revenue & Customs data just released shows, however, that the number of properties owned by offshore companies worth £20m or more (the serious launderer's preferred range) actually increased from 220 in 2013/14 to 230 in 2014/15. In other bands it fell by just 7 percent, showing that a tax running into six figures for properties worth £10m or more is still a price worth paying for secrecy.

ONLY IN THE MAGAZINE

Sun protection

Sun protection

How the Spencer-Churchills became fans of solar energy

Moonlighting

The MPs raking in cash from second jobs

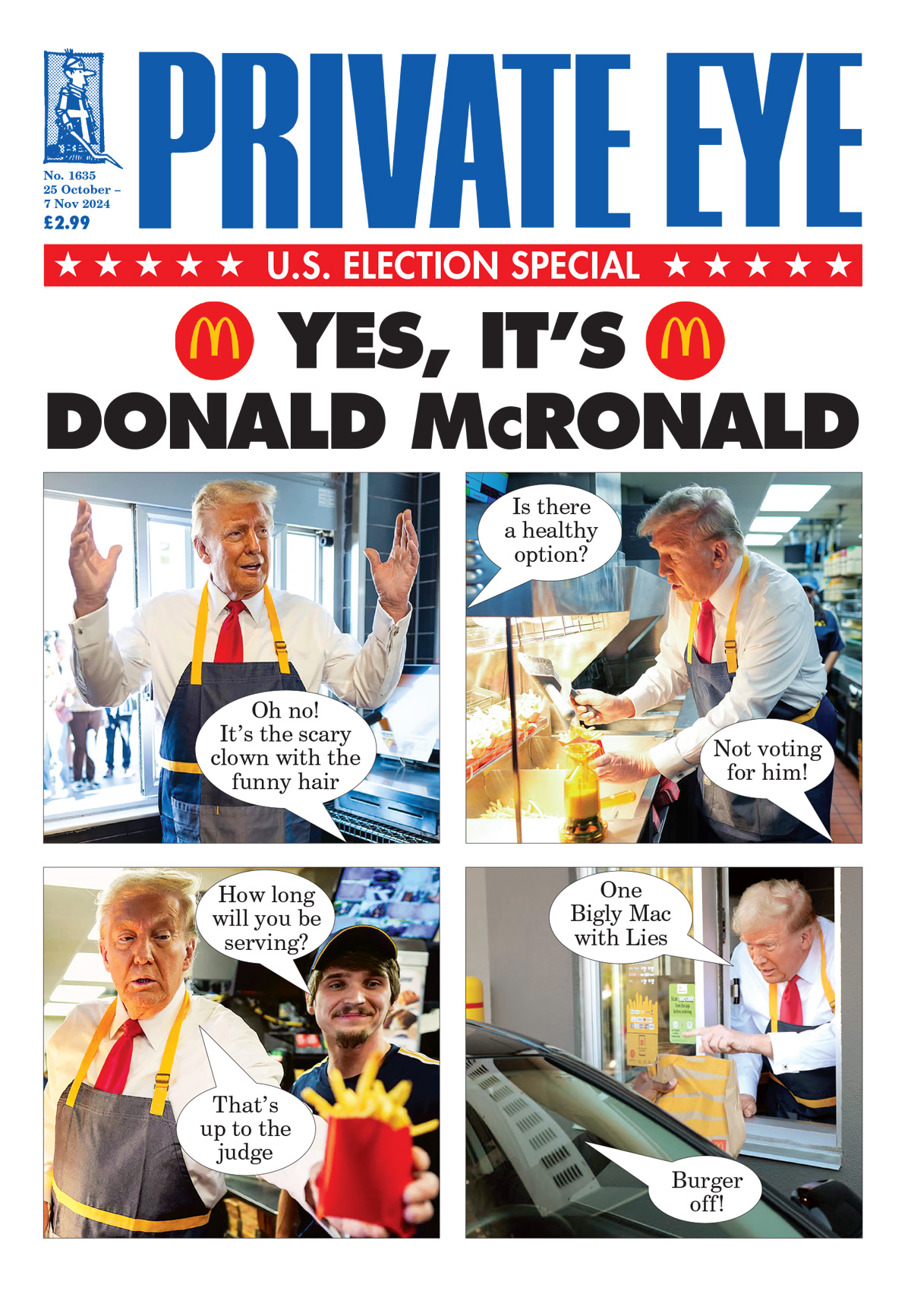

Harris hawks

Nervous times in the Democratic party campaign

Read these stories and much more - only in the magazine. Subscribe here to get delivery direct to your home and never miss an issue!

Secrecy at Guardian HQ Street Of Shame, Issue 1633

Troubled times at the energy firm In The Back, Issue 1635

Who will pay for Fayed's assaults? Columnists, Issue 1633